Once you’ve completed the HMRC Self assessment questionnaire found here the next step is to authorise us as your tax agent via your online personal tax account.

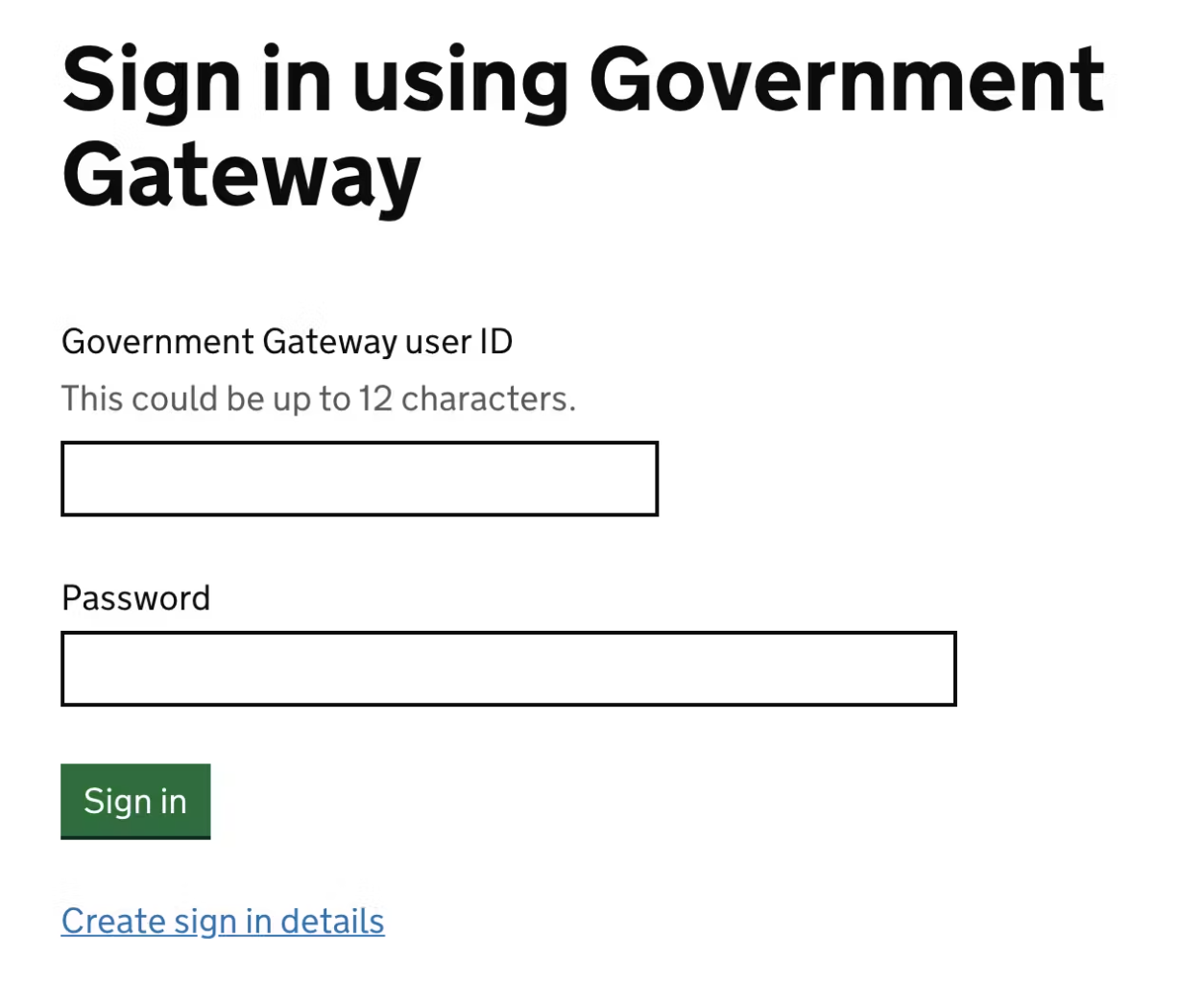

The first step is to sign into your personal tax account via this link here.

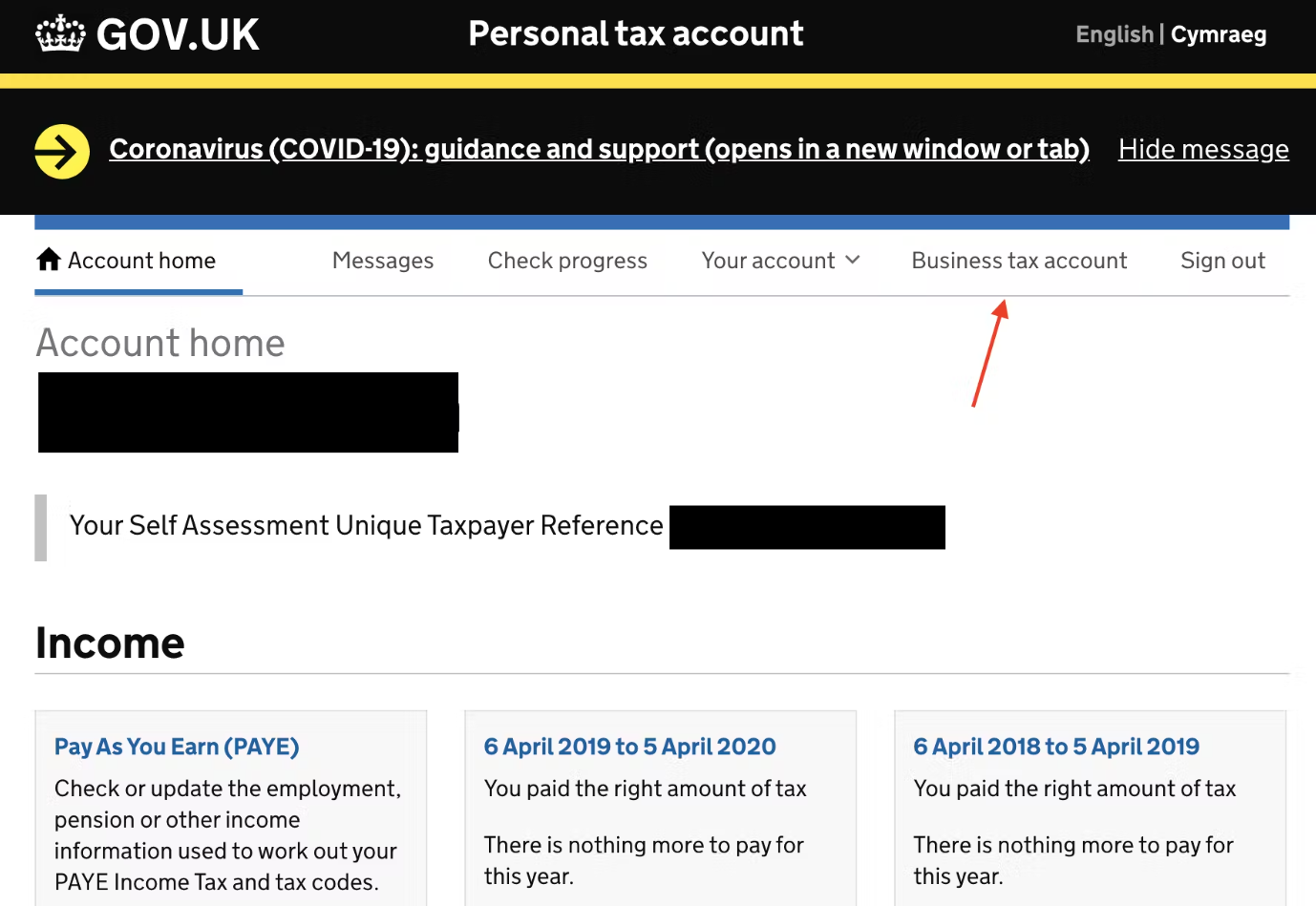

From the menu at the top of the page, navigate to the `Business tax account` section.

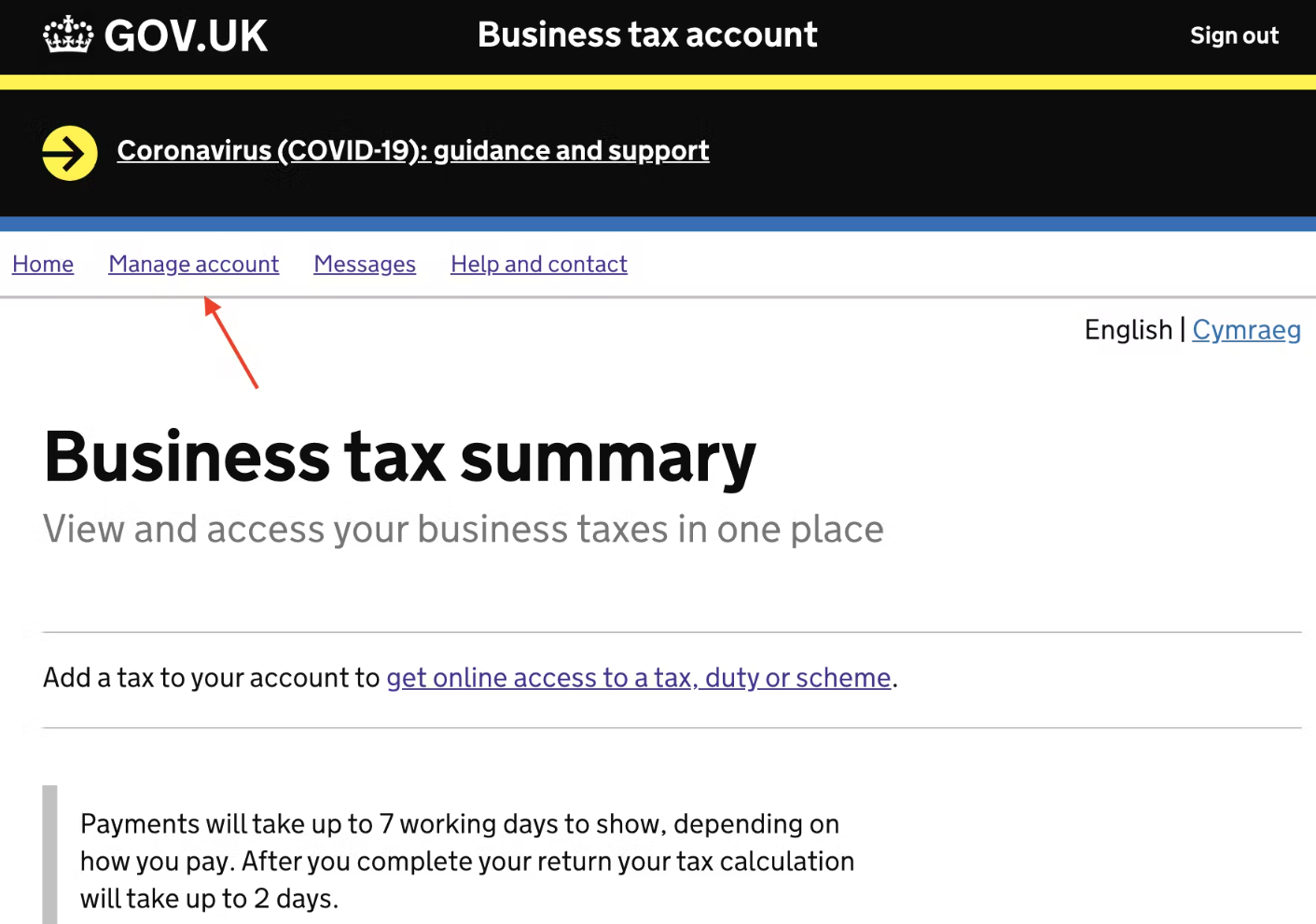

At the top of your menu bar, you should now select `Manage account` from the options.

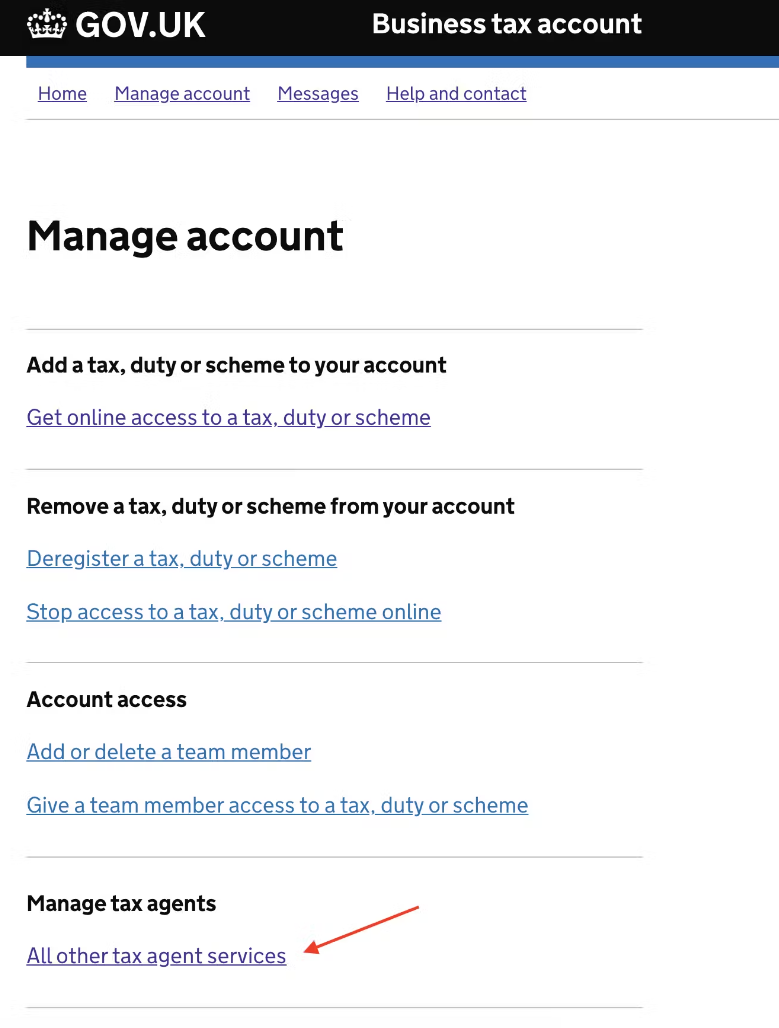

Once you're in this menu, you need to scroll down to the section that says 'Manage tax agents'. Underneath this title you should see a hyperlink to click on named `All other tax agent services`.

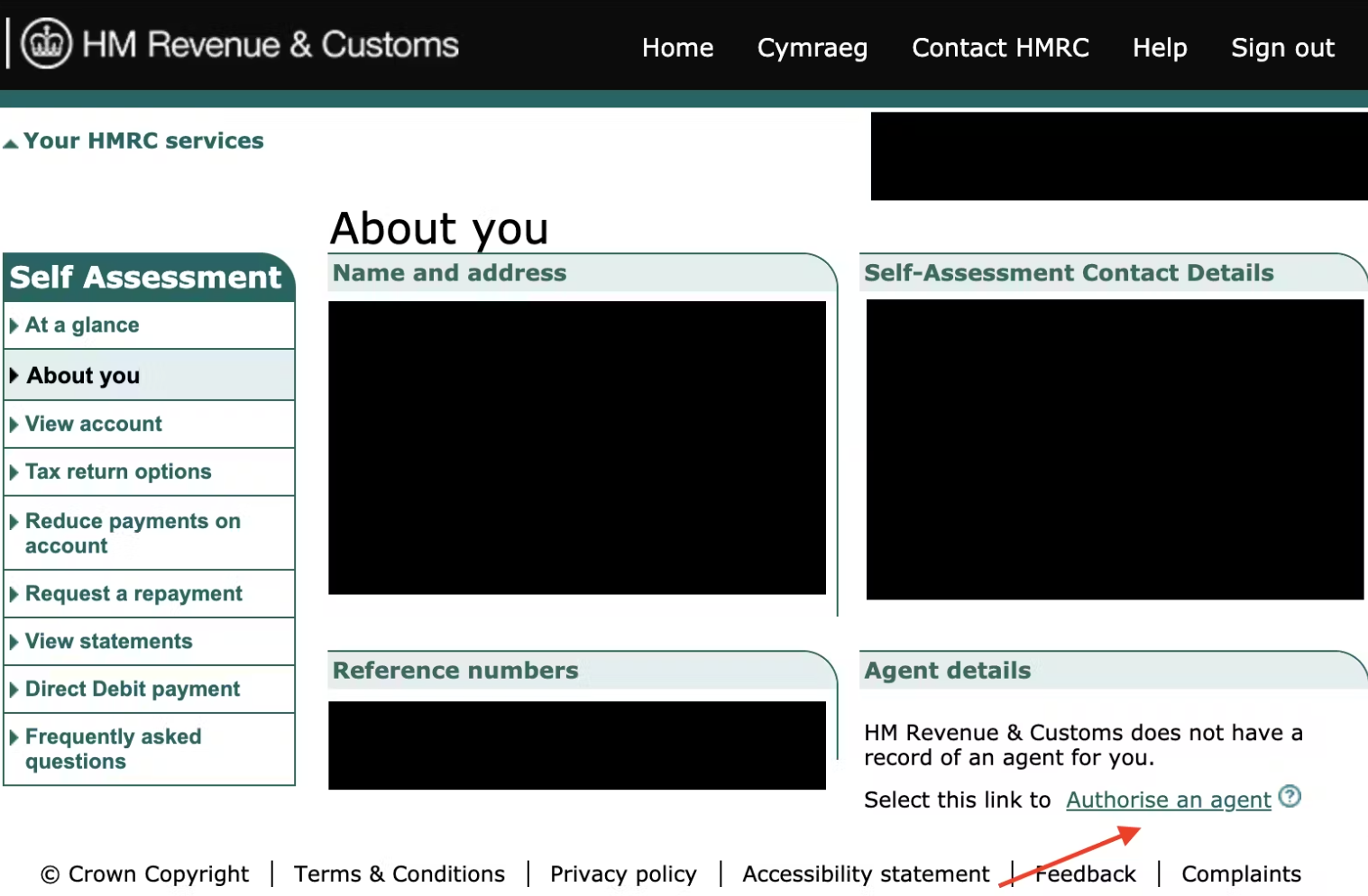

The next screen is an older looking one where you will see on the `About you` a section that's titled `Agent details`. Select the link that says `Authorise an agent`.

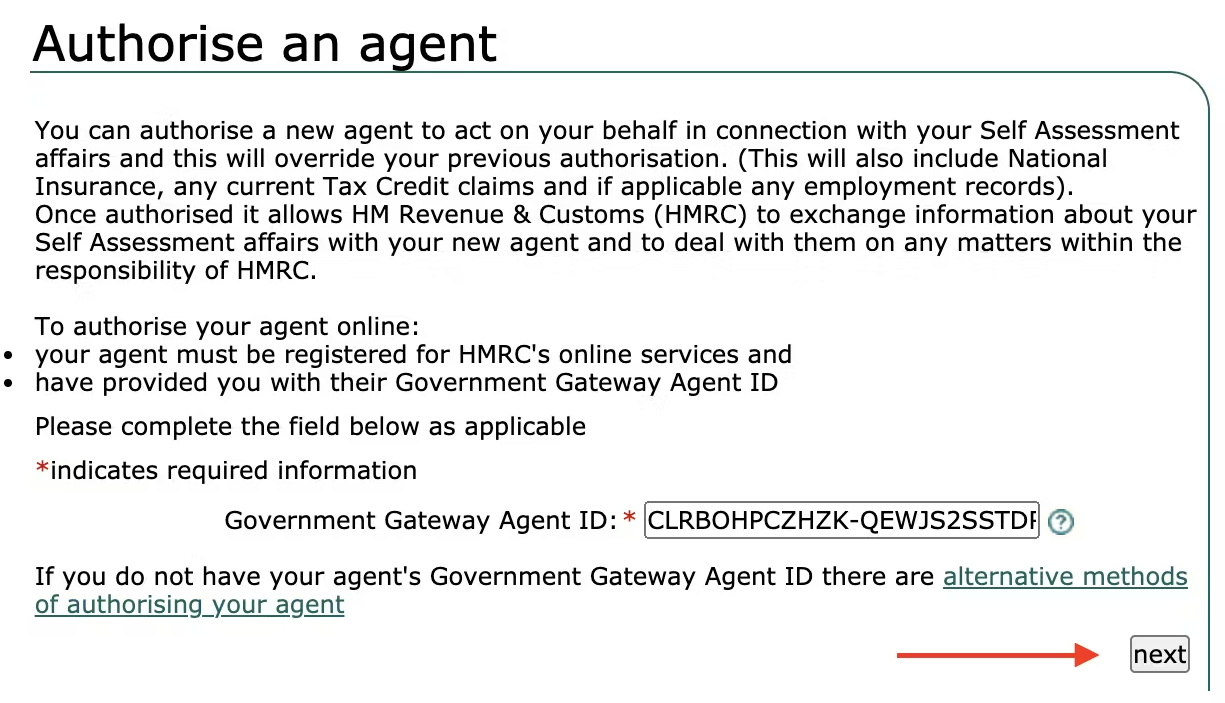

At this stage we will have provided you with the agent code which you need to put in the field provided and press next.

An example agent code looks like this CLRBOHPCZHZK-QEWJS2SSTDRD

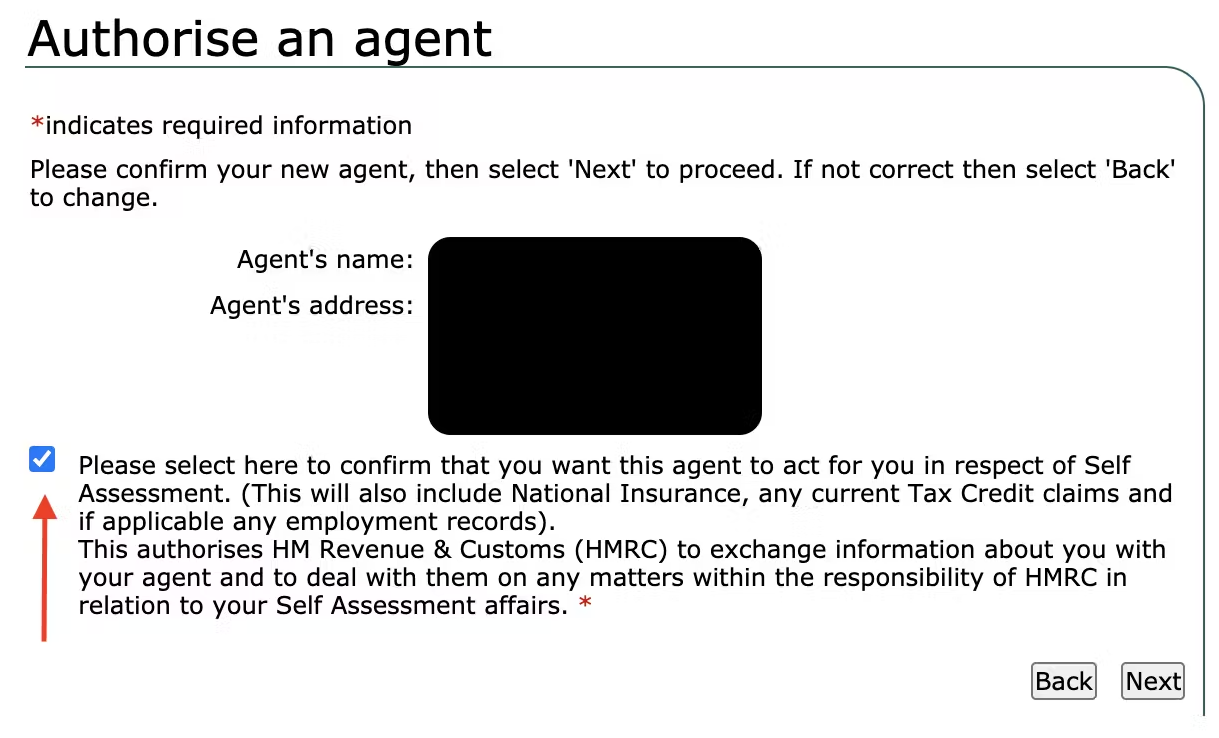

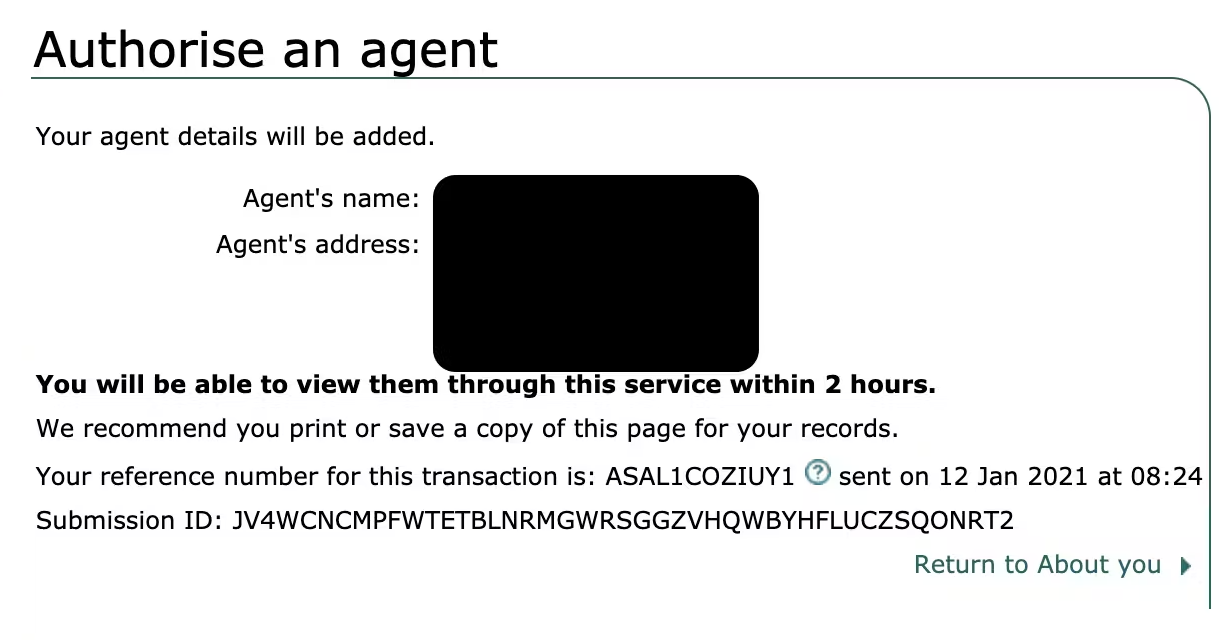

The last step is to ensure the correct agent details have appeared based on the agent code. If you're happy with these, check the box and hit next.

After completion, this will then authorise us to liaise with HMRC on matters that concern your Self Assessment.

Following completion you will now have a shiny new tax agent to help you manage your Self Assessment affairs.